How to Calculate Holiday Pay UK A Practical Guide

Getting UK holiday pay right comes down to two key things: first, figuring out what a worker is entitled to, and second, calculating what 'a week's pay' actually means for them. For your salaried staff on fixed hours, it's pretty simple – it’s their normal weekly salary. But for anyone with variable hours or pay, you’ll need to work out their average pay over the last 52 paid weeks.

Understanding Your UK Holiday Pay Obligations

Before you even touch a calculator, it’s vital to get your head around the legal basics of UK holiday pay. This isn’t just a box-ticking exercise for compliance; it's about being fair and transparent with your team. The whole system is built on one simple idea: employees shouldn't be out of pocket for taking the time off they're entitled to.

This means you can't just pay someone their basic rate if they consistently earn more through commission or overtime. The core principle is that a worker’s holiday pay should reflect what they would have normally earned if they’d been at work.

The Cornerstone Statutory Entitlement

Every calculation starts with the statutory minimum. In the UK, nearly all workers are entitled to 5.6 weeks of paid holiday each year. For someone working a standard five-day week, that’s 28 days. This can include bank holidays, but that's a choice for the employer to make.

For your part-time staff, this entitlement is simply scaled down proportionally – a process known as pro-rata.

It's also worth remembering that this is the legal floor, not a ceiling. Many businesses offer more generous leave as a perk, which is known as contractual leave.

Statutory vs Contractual Leave

Knowing the difference between these two is absolutely critical for managing contracts and running payroll accurately.

- Statutory Leave: This is the 5.6 weeks mandated by UK law. It’s non-negotiable. You have to provide it, and you have to pay for it correctly.

- Contractual Leave: This is any extra holiday you offer on top of the legal minimum. The rules for this additional leave are set out in the employment contract.

So, if you give a full-time employee 30 days of leave, the first 28 days are statutory, and the final 2 are contractual. This distinction really matters when an employee leaves, as the rules for paying out unused contractual leave depend entirely on what’s written in their contract. This is where knowing how to calculate annual leave entitlement for every member of staff becomes essential.

A common pitfall I see is when employment contracts are silent on what happens to unused contractual leave when someone leaves. If you haven't specified the terms, you could be on the hook to pay for all unused days, not just the statutory bit. Always be explicit in your contracts.

What Constitutes 'A Week's Pay'

This phrase, ‘a week’s pay’, is the heart of every UK holiday pay calculation. It sounds simple, but its meaning shifts depending on how an employee works.

For a salaried employee with fixed hours and pay, it's a piece of cake: it’s their weekly salary. But for anyone whose pay fluctuates—think overtime, commission, or bonuses—the calculation gets a bit more involved. You have to find their average weekly earnings over a specific reference period to ensure their holiday pay is a fair reflection of their typical income. We'll dig into exactly how to do that next.

Calculating Holiday Pay for Salaried Staff

Thankfully, when it comes to employees on a fixed salary with set hours, figuring out their holiday pay is usually quite straightforward. Unlike staff whose pay fluctuates, you don't need to get bogged down in the 52-week averaging rules. The principle is simple: they should receive their normal pay when they're on holiday.

Even with its simplicity, it’s vital to have a consistent method. This ensures you’re not only accurate but also transparent with your team. The whole process really just boils down to working out their daily pay rate from their annual salary.

The Basic Calculation Method

First things first, you need to work out what a week's pay looks like. Just take their total annual salary and divide it by 52 (the number of weeks in a year).

Once you've got that weekly figure, you can find the daily rate by dividing the weekly pay by the number of days they typically work. For most full-time employees, this will be five days.

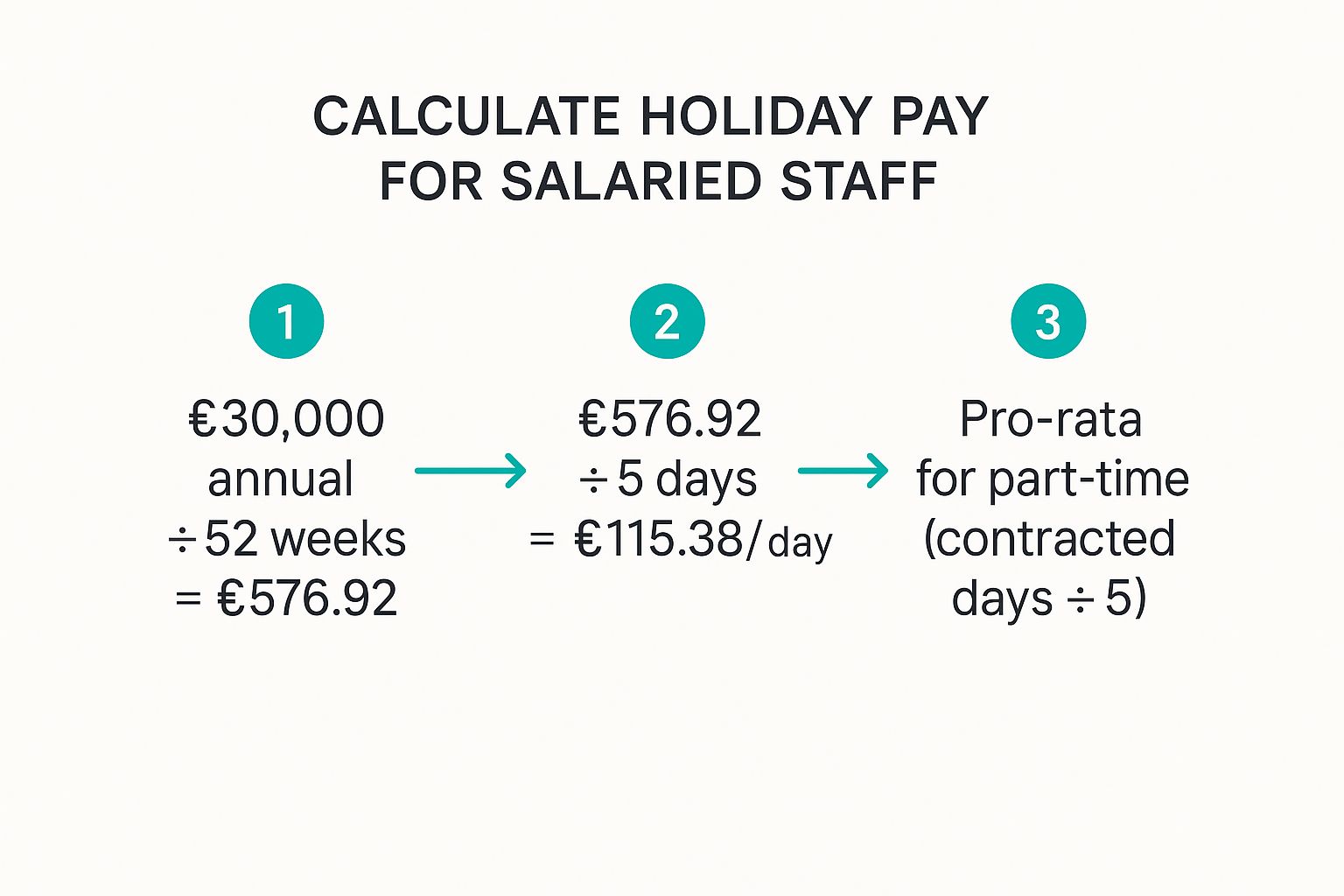

Let's look at a quick example:

- An employee, Alex, earns £30,000 per year and works a standard Monday to Friday week.

- First, we find the weekly pay: £30,000 ÷ 52 weeks = £576.92 per week.

- Then, we calculate the daily rate: £576.92 ÷ 5 days = £115.38 per day.

So, for every day of annual leave Alex takes, he should be paid £115.38. This simple formula is the bedrock for managing holiday pay for all your full-time, salaried staff.

This infographic gives a great visual breakdown of how to get from an annual salary to a daily pay rate.

As you can see, it's about methodically breaking down that big annual number into a practical, daily figure. That daily rate is the key to getting holiday pay right.

Adjusting for Part-Time Salaried Staff

The same logic works perfectly for your part-time salaried staff, you just need to factor in their specific working days. The method for calculating their daily pay rate is identical, but the final numbers will reflect their contracted hours.

Let's take another example. Imagine Ben earns £18,000 per year on a pro-rata basis, working three days a week.

- Weekly Pay: £18,000 ÷ 52 weeks = £346.15 per week.

- Daily Rate: £346.15 ÷ 3 days = £115.38 per day.

You might notice that Ben's daily rate is exactly the same as our full-time employee, Alex. This isn't a coincidence! It's a sign that his pro-rata salary was calculated correctly from the full-time equivalent. This kind of consistency is a hallmark of a fair and well-managed payroll system.

Using this pro-rata approach ensures part-timers receive holiday pay that truly reflects their normal work schedule, keeping things equitable across the entire team. Nailing down this methodology is a fundamental step for any business aiming to calculate UK holiday pay correctly.

Using The 52-Week Reference Period For Variable Pay

This is where calculating UK holiday pay gets a bit more involved. When you have an employee whose earnings fluctuate—perhaps due to overtime, commission, or bonuses—you can't just pay them their basic rate for a week off. Their holiday pay needs to fairly reflect what they typically earn.

The established method for this is the 52-week reference period. It’s a system designed to work out a fair average of an employee's normal earnings, ensuring they aren't out of pocket just for taking a well-deserved break.

Identifying Which Weeks To Include

The heart of this calculation is looking back at the last 52 weeks where the employee actually received pay. The key word there is paid. You have to completely ignore any full weeks where the employee didn't work and, therefore, earned nothing from you.

This is a detail that often trips employers up. If an employee had a week of unpaid leave or was only on statutory sick pay for a full week, that week gets skipped. You then have to go back further in time to find a paid week, and you keep going until you've gathered 52 weeks of actual pay data.

While 52 weeks is the standard, it's worth knowing that you can go back a maximum of 104 weeks to find your data. Any further back than that, and you'll have to assess the situation differently.

A Practical Worked Example

Let's walk through a real-world scenario. Imagine Sarah, a member of your retail team who works variable hours and earns a regular sales commission. She’s booked a week's holiday starting next Monday. Here’s how you'd calculate her holiday pay.

- First, you’d pull her gross pay data for the past 52 weeks leading up to her holiday.

- While reviewing it, you notice two full weeks where she was off sick and received only statutory sick pay (SSP), not her usual company pay.

- These two weeks must be ignored. To get your 52 weeks of data, you'll actually need to look back a total of 54 weeks from when her holiday starts.

Once you have the pay data for those 52 qualifying weeks, you just add up the total gross pay. Let’s say Sarah’s total earnings over these 52 weeks came to £19,500.

The calculation to find her average weekly pay is straightforward: Total Gross Pay ÷ 52 Weeks = Average Weekly Pay £19,500 ÷ 52 = £375

So, Sarah’s holiday pay for that one week of leave is £375. This figure is a much truer reflection of her normal income, as it includes both her base pay and the commission she consistently earns.

What Counts As 'Pay' In The Calculation?

Knowing what to include in the calculation is just as important as identifying the right weeks. It’s not just about the basic salary. You have to include any payments that are intrinsically linked to the job they do.

This typically covers:

- Compulsory and regular voluntary overtime

- Commission payments

- Performance-related bonuses

- Allowances for specific tasks or duties

Generally, you can exclude discretionary bonuses that aren't tied to performance or one-off expense payments. Getting this distinction right is absolutely vital for staying compliant.

This approach ensures fairness for all types of workers, including those on more flexible arrangements. If you manage staff on non-standard hours, it's also worth reading our guide on understanding holiday entitlement on a zero-hour contract to make sure every calculation you make is both fair and legally sound.

Navigating the New Rules for Irregular Hours and Part-Year Workers

Let's be honest, managing holiday pay for staff on zero-hour or term-time contracts has always been a headache. The rules were complex, and the potential for getting it wrong was high. Thankfully, recent government reforms have finally brought some much-needed clarity, aiming to simplify things for everyone involved.

A major change kicked in from 1 January 2024, specifically targeting these flexible working arrangements. For any leave years beginning on or after 1 April 2024, you can now calculate holiday entitlement as a straightforward 12.07% of the hours someone actually works in a pay period. This is a game-changer for sectors like retail and hospitality where variable schedules are the norm.

This new accrual method means we can finally move away from the often-convoluted 52-week reference period for this group of workers, offering a much more direct approach. You can get the full official rundown by reading the complete guidance on the UK government's holiday pay and entitlement reforms.

The 12.07% Accrual Method Explained

So, where does that 12.07% figure come from? It’s not just a random number. It’s calculated by taking the statutory 5.6 weeks of holiday and dividing it by the remaining 46.4 working weeks of the year. This gives us a consistent way to work out holiday entitlement that’s directly proportional to the hours logged.

This method is specifically for two types of workers:

- Irregular-hours workers: These are people whose paid hours are wholly or mostly variable in each pay period. Think casual staff or those on zero-hour contracts.

- Part-year workers: This covers individuals who are only required to work for part of the year, with contract gaps of at least a week where they aren't working and aren't paid. A classic example is a term-time-only school worker.

Having these clear definitions is a huge help, as it removes much of the grey area we used to grapple with. If you need to dive deeper into proportional leave calculations, our team has put together a simple UK guide on how to calculate pro-rata holidays that walks through more scenarios.

Let's look at a practical example. Imagine Chloe, who works casual shifts in a cafe on a zero-hour contract. In May, she worked a total of 80 hours.

- Calculation: 80 hours worked × 12.07% = 9.656 hours

- Result: Chloe has accrued roughly 9.66 hours of paid holiday for that month's work.

When she decides to take that time off, you would pay her for those hours based on her average hourly rate, calculated over the previous 52 weeks. It’s a smart system: the hours are accrued in real-time, but the pay rate still reflects their typical earnings.

The Return of Rolled-Up Holiday Pay

In another significant shift, the new rules have brought rolled-up holiday pay back into the fold for irregular-hours and part-year workers. This practice, which was previously frowned upon, involves adding an extra 12.07% to a worker’s regular pay to cover their holiday entitlement. It means they get their holiday pay with each payslip, rather than when they actually take time off.

This can certainly simplify payroll. However, to stay compliant, it's absolutely crucial that this extra amount is clearly itemised on the payslip as ‘holiday pay’. You can't just bundle it into their standard rate.

While rolled-up pay streamlines administration, it’s worth thinking about the potential downside. The whole point of paid holiday is to let people take a proper break without a financial hit. If they get that money drip-fed in their wages, there’s a real risk they might not feel they can afford to take unpaid time off, which undermines the principle of rest and wellbeing.

Putting This Into Practice

To get these new rules implemented correctly, you’ll need a solid process.

Your first job is to identify which of your team members fit the official definition of an 'irregular-hours' or 'part-year' worker. Once you have that list, you can decide whether to use the accrual method or rolled-up holiday pay.

If you go with the accrual method:

- Track every hour worked by the employee in each pay period.

- Multiply their total hours by 12.07% to find out how many holiday hours they've earned.

- When they take leave, calculate their pay for those hours using their average pay rate from the last 52 weeks.

If you choose rolled-up holiday pay:

- Calculate their total pay for the period based on the hours they worked.

- Add an extra 12.07% of that amount to their gross pay.

- Make sure you clearly label this extra payment as holiday pay on their payslip.

By applying these updated methods carefully, you can make sure your holiday pay calculations for flexible workers are not only accurate but also fully compliant with the latest UK employment law.

Tackling Tricky Scenarios and Common Holiday Pay Mistakes

Payroll is never as straightforward as we'd like. Just when you think you’ve got holiday pay sorted, a curveball comes your way – an employee leaves, goes on long-term sick leave, or starts maternity leave. Handling these complexities correctly is just as crucial as getting the basic calculations right.

It’s also about sidestepping the common pitfalls that lead to costly tribunal claims and unhappy staff. Things like messing up a final payslip or using the wrong reference period are surprisingly easy to get wrong, but they’re completely avoidable if you know what to look for.

Calculating Final Pay When Someone Leaves

When an employee’s contract ends, you need to work out their final holiday pay entitlement. The process is simple in theory: figure out how much leave they’ve built up until their final day and see how that stacks up against what they’ve actually taken.

If they’ve earned more holiday than they’ve used, you owe them a payment for those outstanding days. This is often called payment in lieu of holiday. On the flip side, if they’ve taken more leave than they’ve accrued, you might be able to deduct the difference from their final pay.

Let’s walk through a quick example. A full-time employee with a 28-day entitlement leaves exactly halfway through your company's holiday year.

- Leave Accrued: They've earned half their annual entitlement, which is 28 ÷ 2 = 14 days.

- Leave Taken: Looking at your records, you see they’ve already taken 10 days.

- The Calculation: 14 days accrued - 10 days taken = 4 days owed.

In this case, you’d add four days’ worth of pay to their final payslip. A quick but important tip: you can only deduct pay for excess holiday if you have a clear clause in their employment contract that allows for it. Without that written agreement, you can’t make the deduction.

Navigating Sick Leave and Other Absences

Long-term absences from things like extended sick leave or maternity leave add another layer of complexity. The most important rule to remember is that employees continue to accrue their statutory holiday entitlement while they're off work.

For someone on long-term sick leave, they can carry over up to four weeks of unused statutory leave into the next holiday year. However, they must take this carried-over leave within 18 months of the year it was accrued. During family-related leave, like maternity or paternity, employees build up both their statutory and any extra contractual holiday just as if they were working.

It's a persistent myth that holiday accrual stops during long-term sick leave. UK law is very clear on this: the right to paid time off keeps on ticking. Your best defence against getting this wrong is meticulous record-keeping.

Common UK Holiday Pay Calculation Errors and Fixes

Even the most careful payroll professionals can slip up. Being aware of the most common blunders is the first step towards avoiding them entirely. These mistakes pop up time and time again in employment tribunals.

Here’s a breakdown of the frequent errors we see and, more importantly, how to get them right.

| Common Mistake | Why It's Incorrect | How to Fix It |

|---|---|---|

| Ignoring Variable Pay | Paying holiday based only on the basic salary for staff who regularly earn overtime or commission is unlawful. Holiday pay has to reflect their normal earnings. | Always use the 52-week reference period to calculate an average weekly wage. This must include all relevant earnings, like commission, bonuses, and regular overtime. |

| Misclassifying Workers | Treating a zero-hours or part-year worker like a standard part-time employee will almost certainly lead to incorrect holiday calculations and pay. | Properly identify workers who fit the 'irregular-hours' or 'part-year' definitions. For leave years starting on or after 1 April 2024, apply the 12.07% accrual method. |

| Using the Wrong Reference Period | Forgetting to discount weeks with no pay (like unpaid leave) when calculating the 52-week average will drag down the final figure, resulting in underpayment. | When calculating the average, skip any weeks where the employee received no pay. You can look back up to 104 weeks to find 52 weeks where they were actually paid. |

| Poor Record-Keeping | Without accurate, up-to-date records of hours worked and leave taken, any calculation is just a guess. This leaves you wide open to disputes. | Implement a solid system for tracking hours and absences. Using a dedicated platform like Annual Leave Tracker can automate this, ensuring you always have precise data to hand. |

Getting these details right isn't just about compliance; it's about being a fair and transparent employer. A clear process and reliable tools are your best friends here.

Your UK Holiday Pay Questions Answered

Let's be honest, UK holiday pay can be a real headache. Just when you think you've got the hang of the basic calculations, a tricky situation crops up and throws you for a loop. We get it. That’s why we’ve put together this Q&A section to tackle the most common queries we hear from businesses like yours.

Think of this as your go-to troubleshooting guide. We'll cut through the legal jargon and give you the straightforward answers you need, whether you're working out pay for a new starter or a departing team member.

What Actually Counts as 'A Week's Pay'?

This is the big one, the question that underpins every holiday pay calculation. For your salaried staff on fixed hours, the answer is refreshingly simple: it's just their normal weekly pay. No complicated sums needed.

But for anyone whose pay fluctuates, the definition gets a lot broader. UK law is very clear on this: holiday pay must reflect what they would have normally earned. This means you need to look back at the last 52 paid weeks to work out their average pay.

This average isn't just about their basic rate, either. It has to include any payments that are closely tied to the work they do. We're generally talking about:

- Regular overtime (both compulsory and the voluntary hours they consistently work)

- Commission payments

- Performance-related bonuses

- Allowances for specific tasks

Things like discretionary bonuses that aren’t linked to performance or one-off expense claims are usually excluded. The guiding principle is to make sure an employee isn’t left out of pocket just for taking the time off they're entitled to.

How Do I Calculate Holiday Pay for a New Employee?

This is a really common scenario that trips people up, but the logic is actually quite simple. Since you don't have a full 52 weeks of pay data to look back on, you just use what you've got.

If a new starter has variable pay, you calculate their average weekly pay based on the full weeks they’ve worked for you so far. So, if they’ve been with you for eight full weeks, you average out their earnings over those eight weeks. It’s all about creating a fair snapshot of their typical earnings to date.

For a new salaried employee, it's even easier—you just pay them their normal contractual rate. And for new irregular-hours workers under the latest rules, their holiday entitlement accrues at 12.07% of the hours they work from day one, which keeps the calculation nice and clean for each payslip.

Can I Just Pay Someone for Their Holiday Instead of Them Taking It?

In a word: no. Not while they're still working for you, anyway. The law is incredibly strict here. The whole point of the statutory 5.6 weeks of annual leave is to ensure people get proper rest and a break from work. Paying them in lieu of taking that time would completely undermine the health and safety purpose behind the legislation.

The only time you can legally pay an employee for untaken statutory holiday is when they leave the company. At that point, you're required to calculate any leave they've accrued but not used and pay it out in their final salary.

If you offer extra contractual leave on top of the legal minimum, you can specify in the employment contract whether this additional time can be paid out instead. But this has to be explicitly written into your agreement.

Do Bank Holidays Have to Be Part of the 28 Days?

This is one area where you, as the employer, have some flexibility. The statutory minimum for a full-time worker is 5.6 weeks, which works out as 28 days. You can decide how the eight UK bank holidays fit into that figure.

Many businesses choose to include bank holidays within this total. This often looks like a policy of 20 days of flexible leave plus the 8 bank holidays.

Alternatively, you could offer the bank holidays on top of the 28 days, making it a more generous contractual benefit. The crucial thing is that the total paid leave an employee gets must never fall below the statutory minimum. Whatever you decide, make sure it’s spelled out clearly in the employee's contract. Ambiguity here is a recipe for confusion and disputes down the line.

Trying to manage all these nuances with spreadsheets can quickly become a full-time job. Annual Leave Tracker gives you a simple, clear platform to automate holiday calculations, track what’s been accrued in real-time, and keep accurate records for every employee. Find out how we can simplify your leave management at https://www.annualleavetracker.com.

Ready to Transform Your Leave Management?

Join 500+ companies using Annual Leave Tracker to streamline their HR processes.