Holiday Entitlement Calculator UK | Fast & Accurate Guide

Trying to get your head around UK holiday pay? Let's cut through the confusion. The simple fact is that almost every worker in the UK is legally entitled to 5.6 weeks of paid holiday each year.

If you work a standard five-day week, that works out to a nice, clean 28 days off.

Breaking Down Your Core Holiday Entitlement

Getting this basic figure right is the first, most important step for anyone managing leave. This legal minimum is officially known as statutory holiday entitlement, and it’s the bedrock of all annual leave calculations here in the UK.

It's a widespread right that covers nearly everyone, not just those in traditional 9-to-5 roles. This includes:

- Full-time employees

- Part-time workers

- Staff on zero-hours contracts

- Agency and temporary workers

What's the Deal with Bank Holidays?

This is where things often get a bit muddled. Do bank holidays count towards your 28 days? The short answer is: they can. An employer can choose to include the standard bank holidays as part of your statutory 28 days, or they can offer them on top.

Crucially, there’s no automatic legal right to take bank holidays off.

Think about people working in retail or hospitality – they're often busiest on bank holidays. They are, of course, still entitled to their full 5.6 weeks of paid leave, they just have to take those days at another time.

The Key Takeaway: Your statutory minimum is 5.6 weeks of paid holiday. Your employer can count bank holidays within this total, but the overall paid time off you receive cannot dip below this legal minimum.

For a deeper dive, the official ACAS guidance on checking holiday entitlement is an excellent resource.

Here’s a quick-reference table to see how the statutory 5.6 weeks translates for different work patterns.

Statutory Holiday Entitlement At a Glance

| Days Worked Per Week | Minimum Paid Holiday Days Per Year (5.6 weeks) |

|---|---|

| 5 days | 28 days |

| 4 days | 22.4 days |

| 3 days | 16.8 days |

| 2 days | 11.2 days |

| 1 day | 5.6 days |

Once you've got this fundamental rule down, you'll find it much easier to tackle more complex situations, like working out leave for part-time staff or someone who has just joined the company.

Sorting Out Holiday Pay for Your Part-Time Team

Working out holiday entitlement for part-time staff can feel like a bit of a headache, but the principle behind it is actually quite simple. It all comes down to a pro-rata system. This just means part-timers get the same statutory 5.6 weeks of leave as full-time staff, but scaled to match the hours they work.

The easiest way to get the right figure is with a quick calculation: multiply the number of days they work each week by 5.6. That’s it. This gives you their total holiday entitlement for the year in days.

Putting It Into Practice

Let’s run through a real-world example. Imagine you have an employee, Sarah, who works three days a week.

Here’s her calculation:

- 3 days (her weekly work pattern) x 5.6 (the statutory weeks) = 16.8 days of paid holiday.

Now, you can’t give someone 0.8 of a day off. UK law is very clear on this: you must always round up to the next full day, never down. So, Sarah’s 16.8 days become 17 full days of annual leave.

For a deeper dive into these calculations, check out our complete guide to calculating pro-rata holiday entitlement.

How to Handle Bank Holidays Fairly

Bank holidays are often where things get tricky. What happens if Sarah doesn't typically work on Mondays, when most bank holidays fall? It wouldn't be fair for her to lose out on that benefit.

The fairest and most common approach is to give part-time staff their full pro-rata allowance (so, 17 days for Sarah) inclusive of bank holidays.

If a bank holiday happens to fall on one of her normal working days, she simply uses one of her 17 days to take it off. If it falls on a day she doesn't work, her entitlement isn't affected. This way, everyone is treated consistently, regardless of their work schedule.

Navigating Holiday Pay for Irregular Hours

Trying to calculate holiday pay for casual staff or people on zero-hours contracts can often feel like trying to hit a moving target. When someone's hours are all over the place, a straightforward pro-rata calculation just doesn't cut it. This is where you need a reliable method to figure out what they're owed and stay on the right side of the law.

For a long time, the go-to method for many was the 12.07% calculation. However, things have changed. Recent legal rulings mean this approach is now outdated and could leave you non-compliant. The official, government-endorsed method now uses a 52-week reference period to work out an employee's average weekly pay.

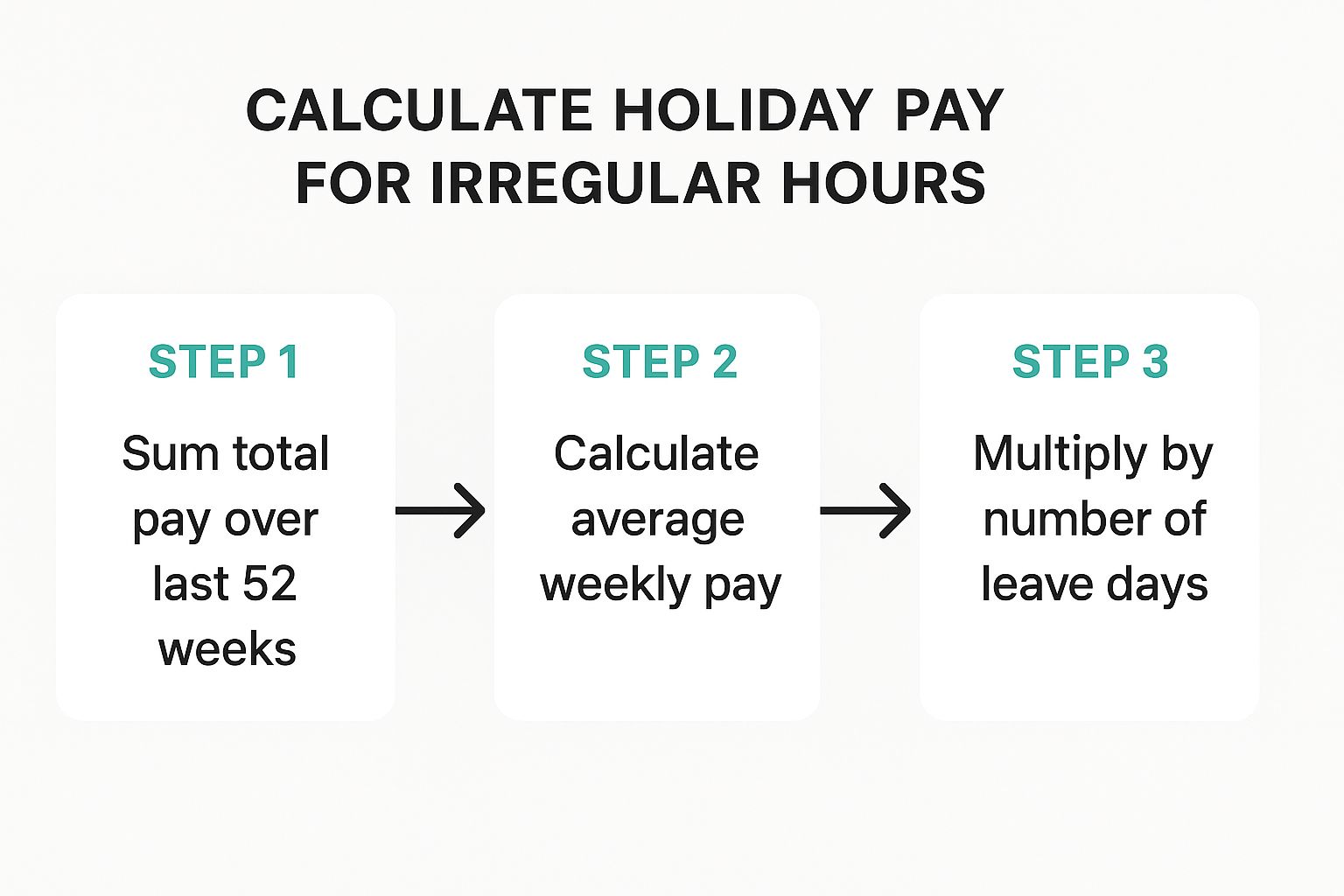

The 52-Week Average Pay Rule

To get this right, you need to look back at the last 52 weeks where the employee actually earned money. It's crucial that you ignore any weeks where they didn't do any work and therefore didn't get paid. If you haven’t got a full year's worth of pay data to look at, don't worry – you just use however many full weeks of data you have available.

This approach ensures that the holiday pay someone receives is a fair reflection of their typical earnings, which should include things like overtime and commission. If you want to dive deeper into how this works for specific contracts, our guide to understanding holiday entitlement on a zero-hour contract is a great resource.

The process of using the 52-week period can be broken down like this:

As you can see, this gives you a clear, legally sound process for making sure your team members with irregular hours get the holiday pay they're entitled to based on their actual earnings.

To make life easier, the UK government has its own tool to help with these tricky calculations. Let's be honest, holiday pay can get complicated with non-standard hours, but their calculator is built to give accurate figures for all sorts of scenarios, from partial years to irregular shifts. It really simplifies compliance. You can learn more about their holiday entitlement calculator on GOV.UK.

Here’s a real-world example: David works in a pub and his hours change every week. To calculate his holiday pay, his manager looks back at the last 52 weeks he was paid. They total up his earnings from that period and divide it by 52. The result is his average weekly pay, and that’s the amount he’s paid for each week of holiday he takes.

Calculating Leave When Starting or Leaving a Job

It’s rare for new starters and leavers to line up perfectly with your company's holiday year. This is where things can get a bit tricky, but getting it right is essential for both your new hire's morale and your leaver's final payslip.

The key is to work out their holiday entitlement on a pro-rata basis. Put simply, they only get the holiday for the time they’ve actually worked for you. Let's walk through a couple of common examples to see how this plays out in the real world.

When a New Employee Joins

Let's say your holiday year runs from January to December. A new full-time employee, Maria, starts with you on the 1st of July.

Because she’s joining exactly halfway through the year, she’ll be entitled to half of the full statutory 28 days of leave.

Here’s the breakdown:

- First, find the monthly accrual: 28 days (full annual entitlement) ÷ 12 months = 2.33 days per month.

- Then, multiply by the months she’ll be working: 2.33 days x 6 months (July to December) = 14 days.

So, for the rest of the year, Maria has 14 days of paid leave she can book.

When an Employee Leaves Your Company

Now, let's look at the flip side. Tom is leaving your company, and his last day is the 31st of March. He's worked three full months of the leave year.

We use the same logic to figure out the holiday he’s earned:

- Again, it's 28 days ÷ 12 months = 2.33 days per month.

- Multiply by his time with you this year: 2.33 days x 3 months = 7 days of accrued holiday.

Next, you need to check his leave records. If Tom has only taken five days of holiday so far, you owe him pay for the remaining two days in his final payslip.

But what if he’s already taken nine days? In that case, he’s used two more days than he'd earned. You might be able to deduct the value of those two days from his final salary, but only if this is explicitly covered in his employment contract. Always check the contract!

Key Insight: That final holiday calculation for leavers is absolutely critical. It decides whether you owe them for unused days or if they've been overpaid for taking too much leave. Getting this right prevents payroll headaches and ensures a clean, professional exit.

Sorting out the final payment is a crucial part of the offboarding process. For a deeper dive into the numbers, check out our guide on how to calculate holiday pay in the UK.

Common Holiday Entitlement Mistakes to Avoid

Getting holiday pay right is about more than just crunching the numbers; it's about steering clear of some surprisingly common slip-ups. A simple mistake can easily lead to unhappy staff and, worse, legal headaches. Thankfully, once you know what to look for, these pitfalls are easy to sidestep.

One of the most frequent errors I see is with rounding. Let's say your calculation for a part-time worker comes out at 16.8 days. The law is crystal clear on this: you must always round up to the next full or half-day. So, that becomes 17 days (or 16.5 if you round to the nearest half-day, but never down). Rounding down to 16 days is unlawful. Simple as that.

Fair Treatment for Bank Holidays

Managing bank holidays for part-time staff is another area where mistakes often happen. It all comes down to fairness. If a part-timer’s usual working days don't include Mondays, they shouldn't lose out just because most bank holidays fall then.

The best way to handle this is to give them their full pro-rata entitlement, including bank holidays. They can then book off any bank holidays that happen to fall on their normal working days using this allowance. It's the only way to ensure everyone is treated equitably, regardless of their work pattern.

The Pitfall of 'Rolled-Up' Holiday Pay

A particularly serious error is the old practice of ‘rolled-up’ holiday pay. This is where an employer adds a little extra to an employee's hourly rate supposedly to cover their holiday pay, instead of paying them when they actually take the time off.

Be warned: this practice is unlawful. The whole point of holiday pay is to ensure people can afford to take a break. It must be paid at the time the annual leave is actually taken.

We see a few recurring themes when businesses get holiday pay wrong. Here’s a quick look at some common mistakes versus the legally sound approach.

Common Calculation Mistakes and Legal Solutions

| Common Mistake | Correct & Compliant Method |

|---|---|

| Rounding Down Fractions | Any fraction of a day must be rounded up to the next half or full day. For example, 12.2 days becomes 12.5 days. |

| Ignoring Bank Holidays for Part-Timers | Part-time staff are legally entitled to a pro-rata share of bank holidays, even if they don't normally work on those days. |

| Paying 'Rolled-Up' Holiday Pay | Holiday pay must be paid at the time the employee takes their leave, not as an extra sum in their regular payslip. |

| Not Including Overtime/Commission | For the first four weeks of holiday, pay must reflect 'normal' pay, which often includes regular overtime and commission payments. |

Avoiding these key mistakes is fundamental to staying compliant. The golden rule is that every single worker is entitled to their 5.6 weeks of paid leave. Your calculations and processes must be fair, transparent, and by the book. Using a reliable holiday entitlement calculator for UK businesses is a great way to prevent these errors from creeping in.

Common Questions About UK Holiday Pay

Even with a handy calculator, the nitty-gritty of holiday entitlement can throw up some tricky questions. Let's walk through a few of the scenarios we see pop up time and time again.

Can my employer tell me when to take my holiday?

In a word, yes. Your employer can require you to take leave on specific dates. This often happens during company-wide shutdowns, like the period between Christmas and New Year.

The key thing to remember is that they can't just spring it on you. Legally, they have to give you proper notice, which needs to be at least double the length of the holiday they're asking you to take. So, if they’re closing for one week, they must tell you at least two weeks beforehand.

What happens to my holiday while I'm on maternity leave?

This is a really important one. While you're on maternity, paternity, or adoption leave, you continue to build up your holiday entitlement just as if you were still at work. This includes your full statutory allowance and any extra days your contract provides.

A lot of new parents find it helpful to tack this accrued holiday onto the start or end of their leave. It's a great way to extend that precious time with their new family before heading back to work.

Key Insight: Your holiday entitlement is fully protected during family-related leave. It keeps accumulating, so you won't lose out on any of your paid time off.

Can I carry over unused holiday into next year?

This depends on the reason you didn't use it. If you were on sick leave and couldn't take your holiday, UK law says you can carry over up to 1.6 weeks of your statutory leave.

For any other reason, there's no legal right to carry over the basic four weeks. However, many companies have their own, more generous policies. Your employment contract is the best place to look – it will spell out the specific rules for your workplace.

Still wrestling with leave management? Annual Leave Tracker offers simple, clean software to get you off spreadsheets and make holiday tracking a breeze for everyone. See how it works at Annual Leave Tracker.

Ready to Transform Your Leave Management?

Join 500+ companies using Annual Leave Tracker to streamline their HR processes.